Navigating the Fog: Earnings and Economic Data in a Shutdown

The market's always a bit of a guessing game, but throw in a government shutdown and you're basically navigating with a blindfold. This week was supposed to give us a clearer picture with earnings reports from Palantir and Uber, plus a slate of economic releases. Instead, we got a mixed bag, and a whole lot of missing data.

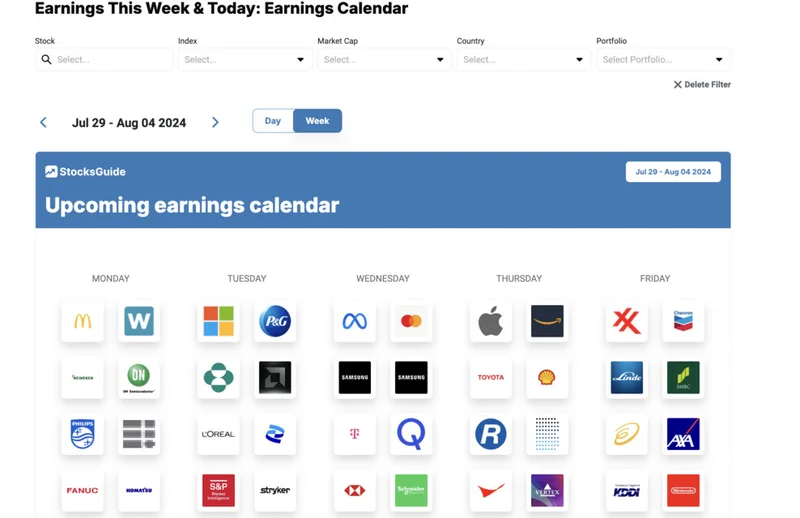

Earnings in the Spotlight

Palantir kicked things off. No huge surprises there (or anywhere, really; surprises tend to get priced in well in advance). Then came Uber. These earnings reports are always dissected, analyzed, and spun six ways to Sunday, but let's cut through the noise. The real question is: are these companies actually making money, or just really good at convincing investors they will someday?

Pfizer also reported. Seeing as people aren't as afraid as they were in 2020 and 2021, it will be interesting to see how they are doing now that the pandemic money is gone.

And then there's the economic data. This is where the shutdown really throws a wrench into things.

The Missing Pieces

Construction spending, JOLTS (Job Openings and Labor Turnover Survey), and the employment situation report—all MIA thanks to the shutdown. That's a significant chunk of information that investors use to gauge the health of the economy. Without it, we're left relying on potentially less reliable indicators.

What data did we get? The ISM Manufacturing PMI came in at 49.5% for October, a slight improvement from September's 49.1%. Still below 50%, indicating contraction in the manufacturing sector, but the direction is at least positive. The ISM Services PMI, on the other hand, showed expansion, hitting 51.1% in October compared to 50.0% the previous month. (A reminder: these are diffusion indexes, so anything above 50 suggests expansion, below 50 contraction.) The ADP Employment Survey showed a gain of 35,000 jobs, a pretty significant jump from the revised -32,000 in September. This is the part of the report that I find genuinely puzzling. The ADP numbers are notoriously volatile and often don't align with the official government figures, but the scale of the revision is notable. Was September really that bad, or is October artificially inflated? I think it is artificially inflated.

Consumer sentiment, as measured by the University of Michigan, ticked up slightly to 54.3 in November from 53.6 in October. Not exactly a ringing endorsement of the economy, but at least people aren't feeling worse. September consumer credit jumped to $11.00 billion, a massive increase from the revised $0.36 billion in August. People are borrowing more. Is it because they're confident, or because they're struggling to make ends meet? I'd bet on the latter.

The fact that consumer credit jumped so high is interesting. It jumped from 0.36B to 11B. If it did that in one month, what will it do in the next few months?

Energy Transfer and Snap also reported earnings this week. I have no idea how they did.

Weighing the Available Data

So, what do we make of all this? We have some positive signals (slight improvements in manufacturing and services, a jump in ADP employment), but also some concerning trends (contraction in manufacturing overall, low consumer sentiment, rising consumer credit). And, of course, huge gaps in the data due to the government shutdown.

It's like trying to assemble a puzzle with half the pieces missing. You can get a general sense of the picture, but you're missing crucial details. The market hates uncertainty, and this shutdown is creating plenty of it. It makes it harder to make informed decisions. For a broader view of the week's market events, consider reading What’s Happening in the Markets This Week.

The Illusion of Clarity

The market's a complex beast. It's hard to say what will happen. Given the limited data, it's hard to get a read on anything.