Blockchain related

Why DeFi's 2025 Rebound Will Redefine Crypto - Thoughts?

Avaxsignals Published on2025-12-06 Views1 Comments0

Avaxsignals Published on2025-12-06 Views1 Comments0

Okay, folks, let's talk DeFi. I know, I know – after the October crash, it's easy to feel like the whole decentralized finance thing is just…stuck. Sideways. But I'm here to tell you, the pulse is still there, and it's about to get a whole lot more interesting. We're not talking about incremental improvements; we're talking about a fundamental shift in how we think about value, ownership, and participation in the financial system.

The Phoenix From the Ashes: DeFi's Next Act

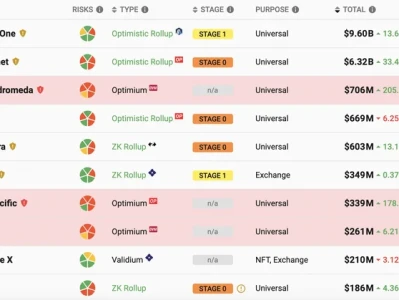

Let's be honest, the FalconX report paints a bit of a gloomy picture. Only two out of 23 leading DeFi tokens in the green year-to-date? Ouch. A 37% average drop for the quarter? Double ouch. But here's the thing about downturns: they’re where the real innovation happens. It’s when the froth gets blown away, and what’s left is the solid, resilient core. And that core, my friends, is where the real magic is brewing.

The Flight to Utility: Finding Solid Ground

Think about it this way: the lending sector might be seeing some compression in fees, but that also means investors are flocking to what they perceive as safer harbors. Lending and yield-related activity is "stickier," as the report says. But I see something more. I see a flight to utility.

It reminds me of the early days of the internet. Remember the dot-com bust? Everyone thought the internet was a fad. But what it really did was clear out all the Pets.coms and leave room for the Amazons and Googles to rise. DeFi is going through its own version of that right now, and the projects that are focused on real utility, real value, are the ones that are going to thrive.

Solana's Game-Changing Potential

And that brings me to my next point: Solana.

I have to admit, I've been watching Solana with a bit of skepticism. All that hype, all those promises of lightning-fast transactions…but the proof is in the pudding, right? Well, the pudding is starting to taste pretty good. The Solana piece talks about consistently achieving 1,000+ transactions per second with near-constant uptime. That’s not just impressive; that’s game-changing.

Proof of History and Proof of Stake: A Powerful Combination

When I read about Solana’s combination of Proof of History (PoH) and Proof of Stake (PoS), I honestly sat back in my chair, speechless. PoH, functioning as a cryptographic timestamping system! In simpler terms, it’s like giving every transaction a super-accurate digital time stamp, so validators can process them more efficiently. And PoS? Securing consensus through token staking, incentivizing network participants to maintain reliability. Put them together, and you've got a system that can confirm transactions in less than 400 milliseconds and process thousands of transactions per second at minimal cost. What this means for us is... but more importantly, what could it mean for you? Imagine a world where financial transactions are as seamless and instantaneous as sending an email. That's the promise of Solana, and it's a promise that's starting to look very real.

Expanding DeFi and NFT Activity: Institutional and Retail Growth

But wait, there's more! The article also mentions the DeFi and NFT activity continuing to expand, with rising institutional and retail participation. This is huge. It means that even after the crash, even with all the uncertainty, people are still building, still investing, still believing in the potential of this technology. According to DeFi Token Performance & Investor Trends Post-October Crash, the market is showing signs of resilience despite recent setbacks.

Ethical Considerations: Building a Better System

Now, let’s inject a moment of ethical consideration into this excitement. With this power, comes responsibility. As we build these incredible new financial systems, we have to be mindful of fairness, accessibility, and security. We can't repeat the mistakes of the old system. We need to build something better, something that truly empowers everyone.

The Search for the Next 1000x Crypto: Innovation and Disruption

And then, I stumbled upon this gem: the search for the next 1000x crypto. Now, I'm not one to chase after moonshots. But the idea behind it is fascinating. It's about finding those small, innovative projects that have the potential to disrupt the status quo and create massive value. Projects like Bitcoin Hyper, scaling Bitcoin through an innovative Layer 2 network, or Maxi Doge, capitalizing on the DOGE meme coin phenomenon. These projects, whether they succeed or fail, are pushing the boundaries of what's possible in DeFi.

Unlocking Creativity and Collaboration: The True Potential of DeFi

But here's the thing that really excites me: the potential for DeFi to unlock new forms of creativity and collaboration. Imagine a world where artists can directly monetize their work, where communities can pool resources to fund projects they believe in, where anyone can participate in the global economy, regardless of their location or background. That's the promise of DeFi, and it's a promise that's worth fighting for.

DeFi: The Dawn of a New Financial Renaissance

This isn't just about making money; it’s about building a better future. It’s about empowering individuals, fostering innovation, and creating a more inclusive and equitable financial system. And that, my friends, is an idea that’s worth getting excited about. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend.