The digital winds, my friends, they’re shifting again, and if you've been paying attention, you can feel the hum of something truly monumental brewing beneath the surface of the crypto world. We’re witnessing not just a market rally, but a profound reawakening, a collective gasp for air in a world increasingly starved of something vital: privacy. And at the heart of this seismic shift? Zcash.

For years, Zcash has been that quiet, brilliant innovator, diligently building the infrastructure for true financial anonymity, often overlooked while the shiny new objects got all the attention. But something’s different now. The launch of Zenrock’s wrapped Zcash token, zenZEC, on Solana, isn’t just another integration; it’s like throwing open the doors of a digital fortress to a bustling, hungry marketplace. Zcash Privacy Meets Solana DeFi with Zenrock’s Wrapped ZEC Crossing $15M in Volume - CoinDesk highlights that with $15 million in trading volume in just ten days, it’s clear the demand isn't just there, it's exploding. This isn't just about speed, though Solana's rapid-fire transactions are certainly a game-changer; it’s about marrying that velocity with Zcash’s unparalleled zero-knowledge proofs, creating a privacy shield that's both impenetrable and incredibly agile. It’s a 1:1 backed token, mind you, by native ZEC, ensuring that the privacy you get is real, tangible, and secure through Zenrock's decentralized multi-party computation network. When I first saw the demos of zenZEC seamlessly integrating with Solana’s DeFi protocols, I honestly just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place, seeing theoretical brilliance become practical, everyday reality.

The Privacy Imperative Rises

Why now, you might ask? Why this sudden, almost feverish demand for digital privacy? Well, look around. The world is changing, and not always in ways that favor individual liberty. The harsh five-year sentence handed down to Keonne Rodriguez, a developer for the Bitcoin privacy app Samourai Wallet, for simply operating an unlicensed money transmitter, sent a chill through the entire crypto community. It was a stark, undeniable reminder that financial privacy isn’t just a feature; it's becoming an act of defiance, a necessity for true digital sovereignty. Suddenly, the abstract concept of "surveillance capitalism" feels very, very real, doesn't it? As Zenrock co-founder Aditya Dave so eloquently put it, "Privacy is core to crypto's ethos." He’s not wrong. We built this space on ideals of decentralization and freedom, and for too long, many of us have let the core tenet of privacy slide. But that’s changing. Fast.

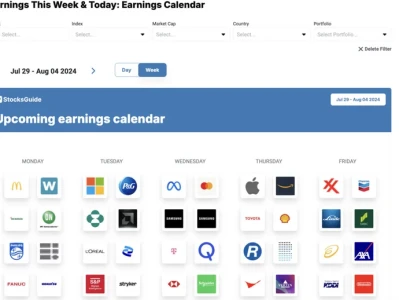

Zcash’s price action tells an undeniable story. We’ve seen ZEC surge by 33% in a single day, up a staggering 74% in a week, and a mind-blowing 1,500% in just two months, hitting highs not seen since January 2018. This isn’t just retail frenzy; it’s the market screaming its demand for a solution. The price action triggered over $51 million in short position liquidations—a brutal shakeout for those who doubted the privacy narrative. Sure, the weekly Relative Strength Index hit a record 94.24, putting ZEC squarely in "overheating" territory, and some analysts like Altcoin Sherpa are calling it a "great short" that might suffer a "violent end," a perspective detailed in Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months - TradingView. But I see something deeper here. This isn't just a speculative bubble; it's a fundamental re-evaluation of value. It's like the early days of the internet, when people scoffed at email as a novelty; they just couldn't grasp the paradigm shift it represented. We're seeing a similar "thought leap" now, where the market is finally waking up to the critical importance of truly fungible, private digital cash.

Beyond the Noise: A Vision for Financial Freedom

This isn’t Zcash’s first rodeo, of course. For those of us who’ve been around, we remember its 2016 all-time high of $3,191. This current surge, while impressive, still leaves it 79% below that peak, which tells you just how much room there might be for growth once the broader market truly understands its significance. Zcash, born from Bitcoin’s codebase in 2016, has consistently pushed the boundaries of zero-knowledge proofs, evolving into a robust, encrypted-money network. We're talking about 20-25% of circulating ZEC now held in encrypted addresses, and 30% of transactions using the shielded pool. The Zashi wallet even made shielded transfers the default, moving privacy from an optional add-on to standard practice. This isn’t just a feature; it’s a commitment. Projects like Tachyon are aiming for thousands of private transactions per second, proving that privacy doesn’t have to sacrifice scalability.

Now, I understand the caution. Historically, such overbought signals have led to sharp corrections. But this time, it feels different. We’re not just seeing tech; we’re seeing a global shift in consciousness. Prominent figures like Naval Ravikant and Arthur Hayes aren't just endorsing Zcash; they're envisioning a future where it's indispensable, with Hayes predicting $1,000 in 2025 and $10,000 long-term. And frankly, when you look at how Bitcoin’s privacy and decentralization are being eroded by corporate and political adoption, it makes perfect sense that people are flocking to the largest privacy-focused cryptocurrency by market capitalization, currently valued at around $11 billion.

What does this mean for us, for you? It means a future where your financial footprint isn't an open book for anyone to read. It means reclaiming a fundamental right in the digital age. But, and this is where we have to pause and consider our responsibility, with great privacy comes great potential for misuse. We need to ensure that as we empower individuals with financial freedom, we also build robust, ethical frameworks that protect society. This is a powerful tool, and like any powerful tool, it demands careful stewardship. Are we truly ready for this level of financial sovereignty, and what does it mean for our collective future? This isn't just about making money; it's about building a better, more equitable, and fundamentally freer financial system for everyone.